Funding Rates Explained: How to Stop Bleeding Fees (and Start Earning Yield)

Funding rates can quietly drain 100%+ APY from your account. Learn how the mechanism works, how to calculate the real cost of leverage, and a simple strategy to farm these fees risk-free.

Most beginners look at the chart, see their PnL is green, and assume they are winning.

But if you hold a leveraged position for weeks, you might be losing money even if the price went up. The culprit is the Funding Rate.

Funding is the mechanism that keeps the perpetual futures price tethered to the spot price. It is exchanged directly between traders every 8 hours.

The Cost of “Ignoring” Funding: A Real Calculation

Let’s say you open a $100,000 Long Position (e.g., 1 BTC at $100k, or 10 ETH at $10k).

The market is bullish. Everyone is long. The funding rate spikes to 0.05% per 8 hours.

Here is the math of what you pay:

| Timeframe | Rate per Interval | Cost (per 8h) | Cost (per Day) | Cost (per Month) |

|---|---|---|---|---|

| 8 Hours | 0.05% | $50 | - | - |

| 1 Day | 0.15% | - | $150 | - |

| 1 Month | 4.5% | - | - | $4,500 |

Read that again. You are paying $4,500 per month just to hold the position.

If the price of BTC goes up 3% that month ($3,000 profit), you actually lost $1,500 because of funding fees.

Lesson: High funding rates kill “buy and hold” strategies on futures.

My “Painful” Personal Experience

I learned this the hard way back in the 2021 bull run. I was Long on SOL when it was ripping. I thought I was a genius because my PnL showed ”+$2,000”.

But I didn’t realize that the Funding Rate had spiked to 0.2% every 8 hours (that’s 0.6% a day!). I held the position for two weeks. When I finally closed it, my account balance was actually lower than when I started, despite the price being higher. I had paid thousands in invisible fees to the Short sellers.

Don’t be me. Check the rate.

How to Check Rates in Real-Time (The Pro Tool)

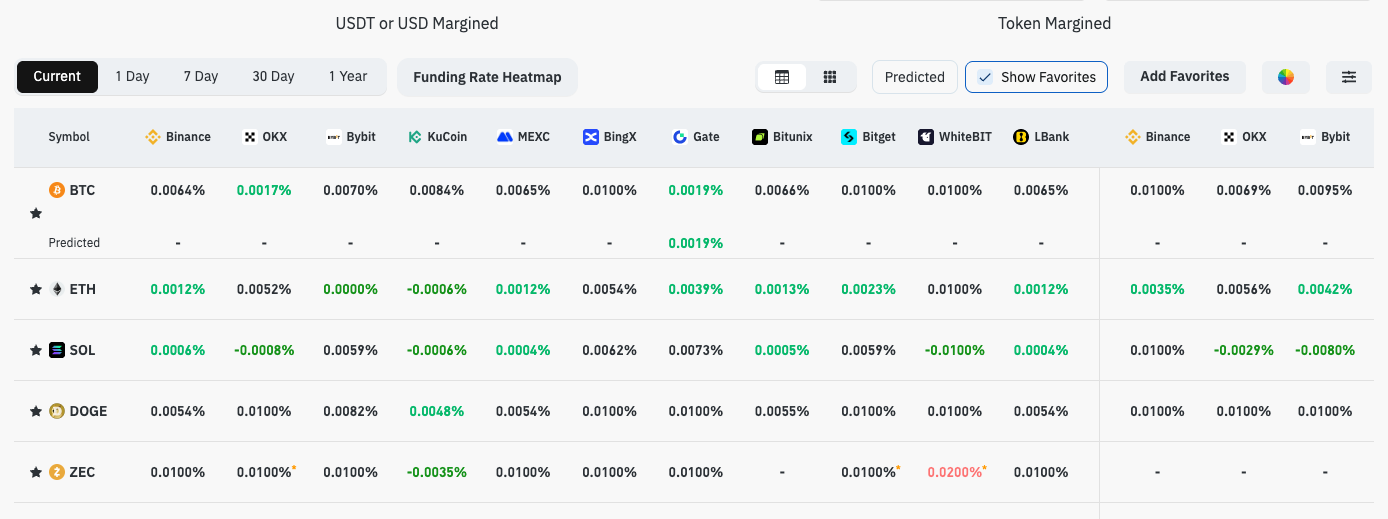

You can’t just check one exchange. You need to see the whole market to know if you’re getting ripped off.

I use CoinGlass (formerly Bybt) for this. It’s the industry standard for visualizing Funding Rates across all exchanges.

Pro Tip: Look for the “Funding Rate Heatmap” on Coinglass.

- If everything is Red/Orange, it means rates are super high. Longs are paying through the nose. This is often a sign of an overheated market (local top).

- If everything is Green/Blue, rates are low or negative. It might be a good time to go Long.

Source: Coinglass.com - Real-time Funding Rate Dashboard

Strategy: Cash-and-Carry Arbitrage (Delta Neutral)

This is how pros farm funding rates with near-zero price risk.

The Setup:

- Buy $10,000 of Spot BTC.

- Short $10,000 worth of BTC-PERP (1x leverage).

The Result:

- If BTC goes up 10%, your Spot makes $1,000, your Short loses $1,000. Net PnL = $0.

- You are “Delta Neutral” (immune to price moves).

The Payoff: Since you are Short, you receive the funding rate every 8 hours. If funding is 0.03% (bullish market):

- You earn $3 every 8 hours.

- You earn $9 a day.

- You earn ~32% APR risk-free.

Risks of Arbitrage

- Liquidation Risk: If you don’t manage your Short margin, a massive pump could liquidate you. (Solution: Keep leverage at 1x).

- Negative Funding: If the market crashes, funding turns negative, and Shorts have to pay Longs. (Solution: Close the position).

Best Exchanges for Funding Strategies

You want an exchange with deep liquidity (so you can enter/exit without slippage) and reliable funding history.

1. Bybit (The Home of Perps)

Known for having stable, predictable funding rates and a massive derivatives user base. Great for arbitrage.

Bybit Exclusive Offer

20% Fee Discount (Spot + Futures)

Clicking will copy the code and open Bybit in a new tab.

2. Binance (Highest Volume)

Often has slightly lower funding rates due to massive efficiency, but deepest liquidity for large size.

Binance Exclusive Offer

20% Fee Discount (Spot + Futures)

Clicking will copy the code and open Binance in a new tab.

Summary Checklist

- Never ignore the rate. Check the “Funding / Countdown” timer on your screen.

- Use Tools. Bookmark Coinglass Funding Rates to see the global picture.

- Don’t hold long-term perps in a high-funding environment. Move to Spot.

- Explore Arbitrage if you have idle stablecoins and want >10% yield.

Why trust this author?

David traded FX derivatives at a bulge bracket investment bank for 10 years before discovering crypto futures in 2019. He specializes in perpetual swaps, funding rates, and leverage strategies. His futures exchange reviews are the most comprehensive in the industry.